Money surprises aren’t usually the good kind.

It’s rarely an unexpected bonus or a forgotten refund check. More often, it’s the flat tire, the medical bill, the fridge that stops working a week before payday. One time, I had a dental surprise and my tooth needed emergency attention because I was in so much pain. These moments are frustrating, stressful, and, for many people, deeply emotional.

You’re not alone if you’ve ever thought, Why does this always happen to me? or I just can’t catch a break.

Experience taught me: life will always throw financial curveballs. The key to staying grounded is learning how to mentally prepare for those moments. When your mindset is ready, your money decisions get better. Let’s break down exactly how to do that.

1. Understand That Financial Surprises Are Normal

First, we need to shift the story. Many people internalize financial surprises as a personal failure. If an unexpected bill shows up, they believe it’s because they didn’t plan well enough or they’re bad with money.

But unexpected expenses are a normal part of life. Cars break down. Kids get sick. Rent increases. None of these things reflect your worth, intelligence, or financial responsibility.

By accepting that surprise expenses are part of the journey, not a detour, you give yourself mental permission to respond instead of react.

2. Rewire the “Panic” Button

When something unexpected happens financially, it’s easy to jump into panic mode. Your brain goes into fight-or-flight, and logical thinking takes a back seat. That’s not a personal weakness, it’s your nervous system doing its job.

The trick is learning how to hit pause before panic takes over.

Here’s a quick exercise:

The next time you feel your chest tighten over a money surprise, breathe in slowly for four seconds, hold for four, then exhale for six.

Repeat this two or three times.

Once your heart rate slows down, ask yourself: What is one small step I can take right now?

That question moves you from panic to problem-solving. And over time, it rewires your brain to feel more capable during high-stress money moments.

3. Build a Mental “Financial Safety Plan”

Think of this as emotional insurance. It’s not just about having an emergency fund, although that’s helpful. It’s about having a mental plan you can tap into when things go sideways.

Try this quick journaling prompt:

If I were hit with a $500 surprise expense today, what would I do?

Walk through the steps in your mind. Would you pause subscriptions? Use a credit card? Ask a friend for a short-term loan? Sell something online?

By mapping it out while you’re calm, you’ll feel more in control when something actually happens. Your brain loves having a plan, it reduces fear and increases confidence.

4. Prepare Emotionally, Not Just Financially

One of the biggest reasons money surprises hit so hard is because they tap into deeper emotions. For example:

A vet bill may trigger guilt for not having pet insurance.

A car repair may bring up shame about not saving more.

An unexpected rent hike may spark fear about losing stability.

To prepare mentally, start recognizing the emotional stories that come up. Ask yourself:

What am I really feeling about this expense?

Am I blaming myself unfairly?

What would I say to a friend who was going through this?

This kind of emotional awareness is a powerful financial tool. It helps you detach your self-worth from your bank balance.

5. Talk About It—Even When It’s Uncomfortable

Money surprises are isolating. Many people suffer in silence, thinking everyone else has it figured out. Truth is, most people are just doing their best.

Opening up to someone you trust can help break the shame cycle. You might say:

“I got hit with an unexpected bill, and it’s been stressing me out.”

“I feel overwhelmed about this expense. Can I talk it through with you?”

Not only does this reduce emotional weight, but you may even hear ideas or resources you hadn’t considered. Community is underrated when it comes to financial resilience.

6. Practice Micro-Preparation

You don’t need thousands in savings to feel secure. Micro-preparation is about small, realistic actions that help you stay calm during surprise expenses.

Here are a few examples:

Keep a $100 buffer in your checking account if possible.

Create a “life happens” envelope with small cash savings.

Bookmark emergency financial resources (like local nonprofits or community aid programs).

Each tiny layer of preparation builds mental confidence. And confidence is what keeps you steady when your finances feel shaky.

7. Forgive Yourself for Past Mistakes

Sometimes financial surprises feel worse because we connect them to past money missteps. Maybe you drained your savings on something you regret. Maybe you ignored a warning light until the car broke down.

Here’s your permission slip: You’re allowed to grow beyond your past.

Mistakes are part of learning. Beating yourself up doesn’t change what happened. But forgiving yourself gives you the clarity to do better next time.

Join over 15,000 subscribers receiving powerful insights every week. Subscribe to Money Tips Money Hacks for deeper dives into the psychology of money, emotional spending, and mindset shifts that lead to real transformation. New posts every Monday and Wednesday.

8. Redefine What “Prepared” Looks Like

Most people think being prepared means having money stashed away and zero debt. But true preparation includes:

Emotional awareness

A calm mindset under pressure

Willingness to ask for help

Creative problem-solving skills

You can be mentally prepared even if you’re not financially “perfect.” And that mental readiness is what turns a $600 surprise into a setback instead of a spiral.

A Nudge in the Right Direction

Life isn’t about avoiding every financial surprise. That’s impossible. But you can build a mindset that helps you meet those moments with resilience instead of fear.

So the next time you’re hit with an expense you didn’t see coming, take a deep breath. Remind yourself that you are not the bill. You are not the broken appliance. You are not your bank balance.

You are a person doing your best. And now, you have the tools to do even better.

❤️ If you find this helpful, leave a heart and share to support my work!

Cervante Burrell, M.Ed., CFEI®, is the founder of Money Tips Money Hacks, a financial wellness educator, husband, and proud father dedicated to helping others thrive financially from the inside out.

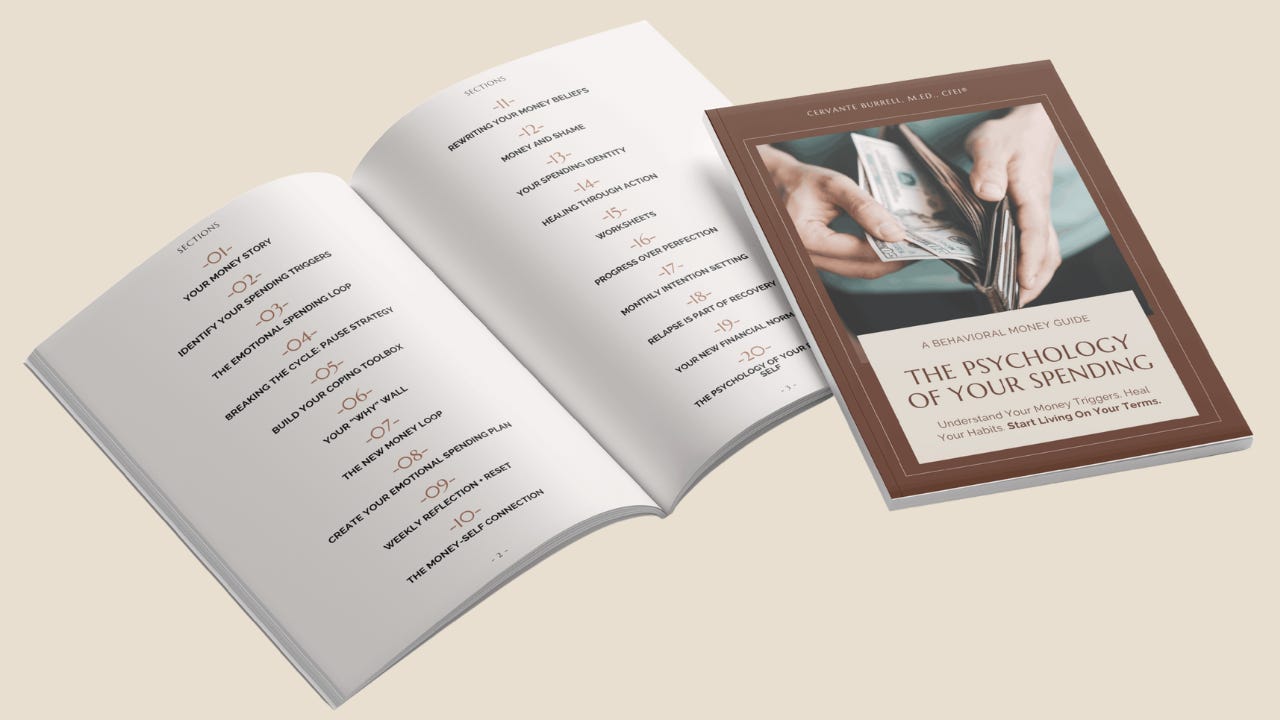

Don’t just stop emotional spending. Start spending in alignment with who you are, what you value, and the life you’re actually building.

The Psychology of Your Spending guide shows you how. Coming September 22nd, 2025.

I had one of these financial surprises recently and for a day or two I did struggle with the panic and stress of dealing with it. But I did take small steps toward resolving the issue and ultimately was able to get it under control before things spiraled. After reading through this though I will be using the life happens emergency envelope method and I'll definitely be learning more about what resources are available to me on the local level cuz there are probably a few I've missed or simply haven't discovered yet.

3