You're not alone if you've ever purchased something for yourself that you truly needed or wanted but then felt bad right away. Spending money can cause guilt more often than we realize. Some of us attribute it to our upbringing. Others link it to scarcity mindsets, past financial errors, or the idea that money should only be spent "responsibly."

You should be able to take pleasure in the results of your hard work without feeling overwhelmed by guilt. Money isn't supposed to make us unhappy, so feeling guilty about taking care of your needs or treating yourself only makes things worse. It's a tool, not a measure of deservingness.

Let's examine how you can finally enjoy what you've worked so hard for and get over your guilt about spending money.

Recognize that you put in too much work to not enjoy what you have earned.

Give your effort some serious thought. The extended hours. The effort you put into your work, your side project, and your obligations. Every day you are there. You don't act carelessly. You're considerate. Why, then, is it so difficult to enjoy what you make?

"I can only spend money on bills or emergencies," is a rule that many people unconsciously follow. Everything else feels "wrong," including joy, travel, self-care, and clothing. However, even when you're doing well, this mentality keeps you in survival mode.

The healthier reality is that you put in too much work to never reap the rewards. You don't need to spend a lot of money to have fun. It simply needs to be in line with your values, objectives, and emotional health.

Try adopting this new perspective: "I manage, I earn, and I get to enjoy." Each of the three is a part of a sound financial partnership.

Know that more cash will reappear

Fear is often the source of guilt. Fear that the money won't return once it leaves your account. That if you spend $50 now, you will eventually run out of money. Usually, though, this isn't the case. It's just your nervous system responding to uncertainty.

Money is exchanged. It moves. Your life's income isn't set in stone; rather, it develops over time based on your abilities, routines, and opportunity management. The secret to overcoming financial guilt is to think of money as a resource that can be replenished.

Here’s a simple mantra: “More money is on the way.”

It indicates that you have faith in your capacity to draw in, generate, and expand your income, not that you spend carelessly. You can do it again because you have done it before.

Love yourself more than money

This one might sting, but it’s powerful.

You're frequently prioritizing money over your own value when you feel guilty after spending money on something worthwhile. "Am I treating money like it's more valuable than me?" ask yourself.

It may sound harsh, but a lot of us are in that situation. More than we value our own needs, happiness, or health, we fear losing money. However, the purpose of money is to serve you, not just to be saved and hoarded.

The prize is you. No amount of money can compare to your worth. Money should be used to help you, not to dominate you.

Start asking: “How can I use money in a way that reflects how much I love and respect myself?”

Whether that’s investing in therapy, buying a better mattress, or taking a much-needed break, you’re worth it.

When you’re in control of your spending and emotions, the purchase becomes rewarding

When spending seems impulsive or disjointed, guilt typically manifests. However, the purchase feels different after you've taken a moment to reflect on your objectives and make an intentional decision.

You feel at ease rather than guilty. You experience pride rather than regret. The way you presented yourself to yourself is more valuable than the item itself.

This is emotional and financial alignment: You’re not buying to escape. You’re buying because it fits.

A simple way to test this? Ask yourself before the purchase:

Does this align with what I value right now?

Am I trying to fix an emotion with a transaction?

Will I still feel good about this tomorrow?

If your answers are grounded and honest, it’s likely a good choice.

Being intentional doesn’t mean being restrictive. It means staying connected to yourself while you spend.

Ask yourself: Would this purchase take all of my money?

Even when the math makes sense, guilt can still occur. Even if you have thousands saved up, you might still feel guilty about spending $40 on dinner.

That’s where this check-in helps: “Would this take all of my money?”

The guilt is probably emotional rather than rational if the purchase is within your budget or cash flow and the answer is no.

You’re not draining your bank account. You’re not compromising your bills. You’re just using a portion of what you earned for something you care about.

So often we treat every dollar like it should only be used for “the responsible thing.” But life is meant to be lived, not just managed.

You don’t have to go broke to enjoy money. You just have to be intentional.

Money Tips Money Hacks dives deep into the psychology of money, emotional spending, and mindset shifts that lead to real transformation. New posts every Monday and Wednesday. Subscribe today. Upgrade to paid anytime.

Last words

Spending guilt is frequently a sign of deeper beliefs, such as the idea that happiness must only be earned after hardship, the fear of running out of money, or shame from past financial errors. However, it is possible to mend your relationship with money, and compassion is the first step.

Compassion for how far you’ve come.

Compassion for how hard you work.

Compassion for the human parts of you that want to enjoy, experience, and express.

Therefore, the next time you make a purchase, no matter how small, stop before guilt sets in and ask yourself:

Did I plan for this?

Does this reflect who I am and what I value?

Am I still financially safe and stable?

If the answers feel right, give yourself permission to enjoy it.

You’re not irresponsible.

You’re not selfish.

You’re simply learning to trust yourself with money and that is something to be proud of.

Remember:

You are more than your bank balance.

You are worthy of joy.

And you can spend money without guilt because you're building a relationship with it that honors both your future and your present.

❤️ If you find this helpful, leave a heart and share to support my work!

Cervante Burrell, M.Ed., CFEI®, is the founder of Money Tips Money Hacks, a financial wellness educator, husband, and proud father dedicated to helping others thrive financially from the inside out.

Start spending in alignment with who you are, what you value, and the life you’re actually building.

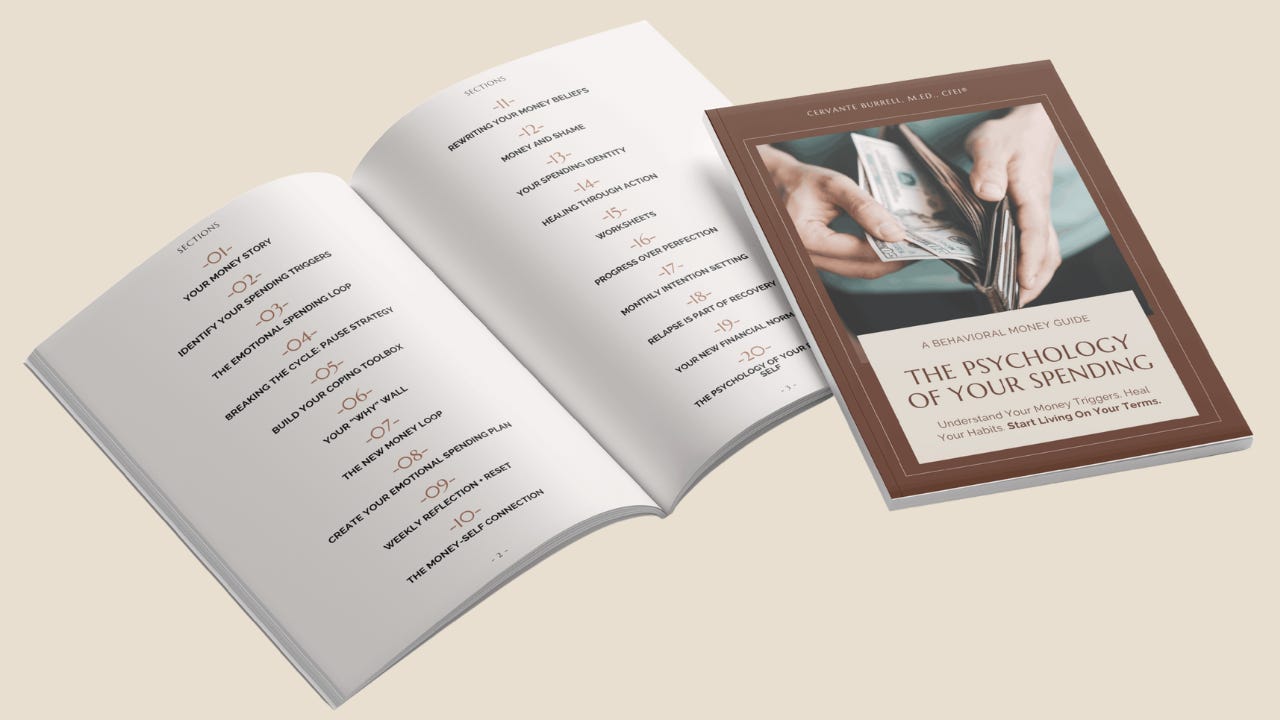

The Psychology of Your Spending guide shows you how. Coming September 22nd, 2025.

This was a refreshing read. So many of us carry quiet guilt for spending on things that actually support our well-being — like a course, tool, or even just rest. I’m realizing that sometimes what feels like “selfish” spending is actually an investment in becoming more grounded, productive, and generous overall.

Thanks! Becoming intentional about your money starts with looking at how you grew up understanding money, and how that carried you to where you are right now.

By peeling away those layers you can, in the process, decide what has worked for you and what has not. Then INTENTIONALLY choose what to keep, what to throw away and what you perhaps realize you need to re-shape, learn, and/or position yourself to experience.