8 Low Energy Financial Habits That Improved My Mental Health

Small Money Habits, Big Peace

I once believed that handling my finances had to be difficult, draining, and overwhelming. I was exhausted from budget spreadsheets, endless apps, rigorous tracking, and attempting to steal every penny. Money felt like a never-ending battle I was losing, which negatively impacted my mental health.

I want to share with you what I've discovered over the years: low-energy financial practices can significantly enhance your financial and mental well-being. These aren't major life changes. These are sustainable, mild changes that yield enormous benefits with little work. These practices may be just what you need if you are feeling worn out, overburdened, or simply exhausted by financial stress.

How I Stopped Chasing Deadlines Forever

I used to manually pay bills, move money between accounts, and remind myself when things were due for hours each week. I couldn't seem to get out of it. The tension was genuine. Then I understood why I was handling my money as though it were a part-time job.

Savings and bill automation revolutionized the industry. My utilities, rent, and subscriptions now pay for themselves. Every month, without my conscious awareness, a certain amount is transferred into my savings account. The daily burden of forgetting or rushing to make payments on time is eliminated by this easy automation.

It's a huge mental relief. I don't worry about deadlines or late fees. My mind is instead freed up to concentrate on more significant tasks, such as work, family, or simply sleeping.

Give it a try. Begin modestly. Select a savings transfer or bill and automate it right now. See how your mental burden is lifted by that small change.

Why Giving Yourself Permission to Spend Changed Everything

One of the most draining things about money is decision fatigue. When every dollar feels like a choice you have to agonize over, your mental energy tank runs out fast.

I started a no-brain spending rule for a small, fixed amount each week. For me, that is $20. I can spend it on whatever I want, a burrito, a book, a snack, or even a spontaneous treat. No guilt, no calculation, no judgment.

This habit helped me break free from the stress of constant rationing. It gave me permission to enjoy money mindfully without overthinking. It is low energy because it is simple, and it improved my mental health because it introduced balance and kindness to how I view spending.

Try this. Give yourself a no-brain spending budget. Make it small enough to not harm your overall goals but large enough to feel like freedom.

What I Found When I Cleared Out Hidden Money Drains

Confession. I was subscribed to so many services I barely used streaming apps, magazines, memberships, software trials I lost track. The clutter made me feel out of control and guilty every time a bill came in.

Taking 15 minutes to review my bank and credit card statements and cancel what I did not need was surprisingly freeing. It simplified my monthly expenses and reduced the noise in my mind.

The key here is not to be harsh or deprived but to create clarity. Less clutter in my financial life meant less anxiety and fewer surprises.

Try this. Pick one account and scan your recent transactions. Cancel one thing you do not use or want. Feel the mental space expand.

Why Perfect Tracking Was Holding Me Back

I once tried to track every single expense to the cent detailed categories, exact amounts, daily logging. It was exhausting and honestly, not sustainable.

What helped me was shifting to a good enough money tracking system. Instead of obsessing over every dime, I check my bank app once a week to get a general sense of where my money is going. If something looks off, I investigate. Otherwise, I keep it simple.

This approach takes less time and mental energy but keeps me aware enough to avoid surprises or slipping into bad habits. My anxiety around money dropped because I wasn’t drowning in details but still stayed informed.

Try this. Check your accounts weekly, or daily. Do not stress about perfect categories. Just stay casually aware.

The Tiny Change That Took the Pressure Off Emergencies

Before, I thought emergency funds had to be large and forever growing. That made me avoid starting because the goal felt too far away and discouraging.

Instead, I started with a tiny buffer just $50. It was small enough not to feel intimidating but enough to bring peace of mind that I had something set aside.

Over time, I added more without stress or pressure. That small buffer grew into a real safety net that protects me emotionally when unexpected expenses come up. Knowing I have some backup means less panic and sleepless nights.

Try this. Start with a tiny emergency fund. Celebrate the progress no matter the size.

A Simple Trick That Changed How I Spend

I am not a cash-only person, but I found that using cash for small discretionary spending helps me feel more grounded and intentional.

When you hand over actual bills, the money feels more real and spending it hurts a little more. This naturally slows down impulse purchases and makes you think twice without overcomplicating things.

It is a simple, low-tech trick that calms the mental buzz of card swipes and app payments. Sometimes, slowing down is all your brain needs to relax.

Try this. Take $60 in cash for the week’s discretionary spending and leave cards at home. Notice how it feels.

How Money Talk Can Suck Your Energy

I am a big believer in talking openly about money, but I also learned that constant complaining or worrying with others can drain your mental energy.

If you surround yourself with people who are negative or anxious about money, it is easy to catch those feelings. It does not help solve problems. It just adds to stress.

I started setting boundaries around money talk, choosing when and with whom I discuss financial challenges. I focus on solutions or positive mindset shifts instead of venting.

This change saved my mental space and helped me keep a healthier outlook on my financial journey.

Try this. Notice how money talk affects your mood. Limit exposure to negative conversations or steer them toward solutions.

Subscribe to Money Tips Money Hacks for deeper dives into the psychology of money, emotional spending, and mindset shifts that lead to real transformation. New posts every Monday and Wednesday.

Why Celebrating Small Wins Feels So Good

It is easy to feel discouraged when you focus only on what is missing or what is not your way. That mindset drains your motivation and mental health.

I started celebrating small wins: a paid bill, a tiny savings deposit, or skipping a needless purchase. These small celebrations gave me a positive emotional boost and kept me connected to progress.

It turns money management into a series of gentle victories instead of constant pressure.

Try this. At the end of each week, note one small financial win and celebrate it maybe with a moment of gratitude or a quiet reward.

Why These Habits Matter for Mental Health

Money stress is one of the biggest contributors to anxiety and depression. The pressure to do everything perfectly or to constantly hustle for more can wear you down.

Low energy financial habits reduce decision fatigue, create clarity, and foster kindness toward yourself. They create space for calm, confidence, and control.

When you do not have to think 24/7 about money chaos, your brain can relax. When you give yourself permission to be good enough, you build resilience. When you automate and simplify, you avoid burnout.

Last Words

If you are struggling with money and mental health, know that you do not need to overhaul everything at once. Start with one small, low-energy habit today.

Give yourself grace. Money is not a test of worth. It is a tool to support your life and peace of mind.

These gentle habits helped me transform my relationship with money and my mental health and I believe they can do the same for you.

If you want more practical tips and encouragement for managing money without burnout, I am here for you. What is one low energy financial habit you want to try? Let me know.

❤️ If you find this helpful, leave a heart and share to support my work!

Cervante Burrell, M.Ed., CFEI®, is the founder of Money Tips Money Hacks, a financial wellness educator, husband, and proud father dedicated to helping others thrive financially from the inside out.

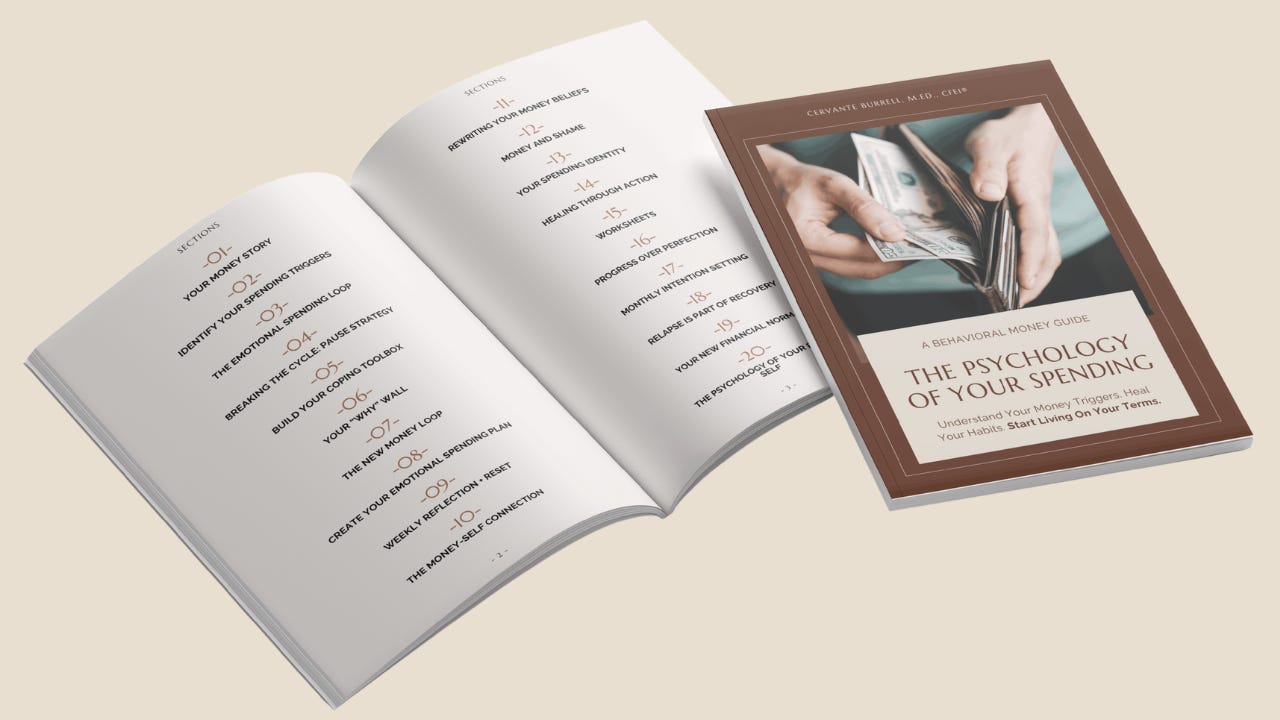

Start spending in alignment with who you are, what you value, and the life you’re actually building.

The Psychology of Your Spending guide shows you how. Coming September 22nd, 2025.

Great ideas! One thing I do that makes a huge difference automatically transfer money every week to a savings account, a medical/health account , and a miscellaneous account. It’s made my life easier. I’m adopting your suggestion of weekly money for fun- the book or the pizza. And I’m taking cash for it. Great ideas in this post.

Excellent read!