Between bills, small splurges, and everyday life, it’s easy to lose track of your money. You might download the budgeting apps, binge finance videos, even follow money professionals online—but the clarity still doesn’t come.

You can’t build a better financial life without being honest with yourself first.

That’s why I believe money clarity starts with questions, not numbers.

Not "How much do I make?" or "What’s my credit score?" (those matter, yes, but they come later). I'm talking about the questions that bring you back to why you spend, save, hustle, and worry in the first place. The questions that help you feel aligned with your money, not just organized.

These 9 honest questions are the same ones I asked myself when I was tired of repeating the same cycles. They won’t give you a one-size-fits-all plan. But they will give you the clarity to create one that actually fits your life.

Let’s get into it.

1. What does “enough” look like for me?

We live in a world that convinces us more is always better. More income. More luxury. More success.

But the question is, what’s enough for you?

Enough income to feel secure.

Enough time to enjoy your life.

Enough freedom to be present with your family.

When you define your version of enough, you stop chasing someone else’s idea of success. That clarity alone can calm your financial anxiety more than any dollar amount.

2. What do I value more than money?

Money is a tool. It’s not the goal.

Think about what you value most. Is it freedom? Peace of mind? Experiences with your kids? Creative expression?

When you know what matters more than money, you stop trading your values for temporary distractions. You make financial choices that feel aligned. You spend, save, and invest with purpose.

3. When do I feel most tempted to spend emotionally?

This question changed everything for me. I used to think I had a discipline problem, but really, I had an emotional blind spot.

I spent more when I was feeling insecure, prideful, or angry. Once I noticed the pattern, I could disrupt it. I could pause before buying, ask what I was really needing, and meet that need in a healthier way.

Money clarity means understanding not just what you spend on, but why.

4. What are my earliest money memories?

Whether we realize it or not, many of our adult money beliefs come from childhood. Maybe you grew up hearing “that’s too expensive” or watched your parents argue about bills. Maybe you learned to associate money with stress, guilt, or scarcity.

Revisiting your early money memories helps you spot unspoken stories you’re still carrying. And when you see those stories, you can choose to rewrite them.

5. Who taught me what I believe about money, and do I still agree with them?

It could be your parents, a teacher, or even culture at large. But pause and ask yourself, Do I agree with that belief now?

Maybe you were taught that wanting wealth is selfish. Or that talking about money is impolite. Or that being poor is a moral failing. When you slow down and evaluate those beliefs, you gain the power to release the ones that don’t serve you.

Clarity comes from questioning the internal rules you've been following on autopilot.

6. What does financial freedom actually mean to me?

For some, it’s early retirement. For others, it’s the ability to take a month off without panic. It could be debt freedom. Or owning a home in your name. Or simply having space to breathe.

Get specific.

You can’t chase freedom if you don’t know what it looks like for you. The more personal your definition, the more motivated and focused you’ll become.

7. What am I avoiding when it comes to my finances?

This one’s tough, but necessary. What are you pretending not to see?

A growing credit card balance? A subscription you don’t use but haven’t canceled? A job that’s underpaying you but feels “safe”?

Avoidance creates fog. Fog keeps you stuck.

Money clarity means turning on the lights, even when it’s uncomfortable, so you can make clear, conscious decisions again.

8. How do I define wealth outside of money?

Wealth isn’t just about your net worth. It’s also about:

Your relationships

Your health

Your peace of mind

Your ability to choose how you spend your time

When you broaden your definition of wealth, you realize you’re already richer than you think. That mindset shift creates gratitude. Gratitude transforms how you relate to money.

Subscribe to Money Tips Money Hacks for deeper dives into the psychology of money, emotional spending, and mindset shifts that lead to real transformation. New posts every Monday and Wednesday.

9. What small step can I take today to feel more aligned with my money?

Clarity doesn’t come all at once. It’s built, piece by piece, through intentional action.

Maybe that small step is opening your banking app without flinching. Maybe it’s journaling about one of these questions. Maybe it’s setting a timer to review your expenses for 15 minutes. Or reaching out to a friend who’s also on a financial healing journey.

No matter how small, take one step today.

Because clarity comes from doing, not just thinking.

Getting clear with your money isn’t about tracking every penny or building the perfect budget. It’s about getting honest.

Honest with how you feel. Honest with where you’ve been. Honest with where you want to go.

These 9 questions are a starting point, not a checklist. Come back to them whenever you feel disconnected or overwhelmed. Let them be a compass when the financial noise gets too loud.

Once you have clarity, every choice becomes simpler. You’ll stop chasing someone else’s financial goals and start building a life that actually feels like yours.

And that? That’s big time.

❤️ If you find this helpful, leave a heart and share to support my work!

Cervante Burrell, M.Ed., CFEI®, is the founder of Money Tips Money Hacks, a financial wellness educator, husband, and proud father dedicated to helping others thrive financially from the inside out.

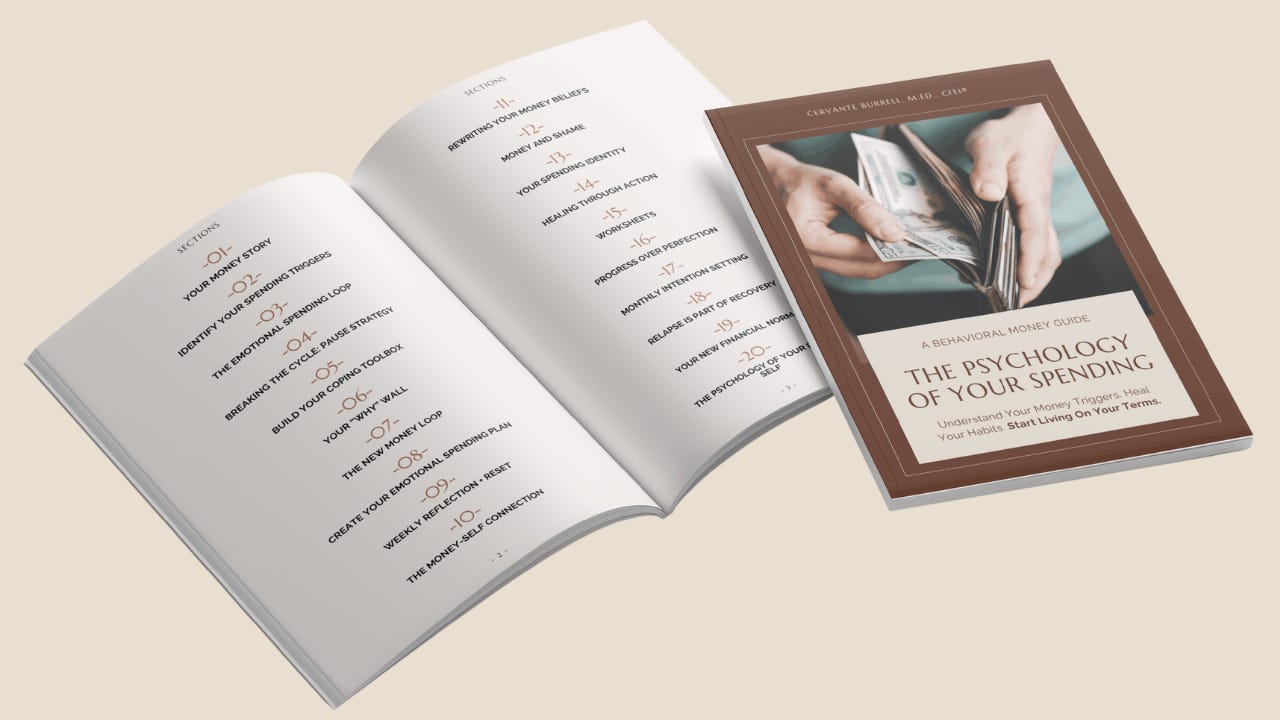

Start spending in alignment with who you are, what you value, and the life you’re actually building.

The Psychology of Your Spending guide shows you how. Coming September 22nd, 2025.

I love that you start with questions. So much easier than “telling” me something. Same goal, better outcome. Nice work! Keep up the great posts.

Love your content!!!!!!!