My daughter is at the age where she loves to play outside with the neighbors.

I’m at the age where I still can’t take my eyes off her or trust anyone with my little boo.

Watching her grow is one of the greatest rewards of my life. She’s learning how to mush socially with all kinds of people — older kids, toddlers, shy ones, bold ones. It’s a joy to witness.

To support the both of us, I decided to buy outdoor furniture so we could sit outside while she played with the community crew. Simple setup. Just a few chairs and a table for snacks, maybe my laptop if I’m working while she’s chasing bubbles.

Even though I was done spending for the month, this felt important. And sometimes, that’s all the reason you need.

A Decision That Felt Right

So I made a call: I used Klarna.

The Buy Now, Pay Later model gave me breathing room. It let me fix a need without increasing this month’s expenses too much. I only had to pay a fraction upfront, and the rest on a biweekly payment plan.

It felt like the most aligned decision I could make. I didn’t use it because I couldn’t afford it. I used it because I had options, and this one honored both my financial plan and my daughter’s joy.

But the very next day, I came across a headline that gave me a pause:

“6 Dangers of Buy Now, Pay Later Apps — And How to Avoid a Debt Trap.”

My heart dropped a little. That wasn’t the energy I had when I made the decision. That wasn’t my story. But I couldn’t deny it could be someone else’s.

And that’s when my favorite line hit me:

There Are Always Two Options

There’s always more than one narrative when it comes to spending money and life decisions too.

There’s fear, and there’s wisdom.

There’s reckless, and there’s responsible.

There’s the shame story, and there’s the self-trust story.

Most headlines are written for clicks, not context. But your money choices do deserve context.

So today, I want to share my own version:

6 Positives of Buy Now, Pay Later — And How to Avoid the Debt Trap Without Shame

1. You Have the Money — You Just Don’t Have to Use It All Now

Sometimes you’ve got it in the bank, but you’d rather not drain a lot in one swipe. That’s strategy, not scarcity. Choosing to stretch a purchase doesn’t mean you’re broke. It might mean you’re being intentional.

When you play the long game with your money, spacing things out can help keep your cash flow smooth.

2. You Avoid the Pain of a Lump-Sum Expense

Let’s be real. Dropping $400 in one day can sting, even if you’ve got it.

Breaking it into smaller payments over time allows your budget to absorb the impact. You still pay the same total if it’s 0% interest, but you soften the blow and maintain peace of mind.

3. You Meet a Real-Time Need Without Delay

My daughter won’t be this little forever.

If I waited another month to get the furniture, she would’ve had 30-plus days of playing while I stood awkwardly holding my phone. Instead, we get to enjoy that time together now, comfortably and intentionally.

Sometimes the right time is now, and it’s okay to honor that.

4. You Stay in Control (If You Choose To)

This part is key.

I treat Klarna like a short-term tool, not a lifestyle. I don’t make another Buy Now, Pay Later purchase until the current one is fully paid off. That boundary keeps me in control and prevents things from snowballing.

Spending is never the problem. Unconscious spending is.

5. You Only Choose 0% Interest Offers

Not all Buy Now, Pay Later services are created equal. Some charge interest, some don’t. I only use the ones with zero interest and fixed payment schedules.

That’s the deal breaker. If there’s interest or fees, it’s a no-go for me.

Always read the options, even if the checkout button is tempting.

6. It Aligns With Your Values

At the end of the day, this is what it all comes down to.

Does the decision feel aligned with your values, your vision, and your actual financial plan?

If yes, stand on that. Own it.

If not, pause, breathe, re-evaluate.

No shame either way. But the only trap is when we ignore our intuition or give in to guilt because someone else told us we should feel bad.

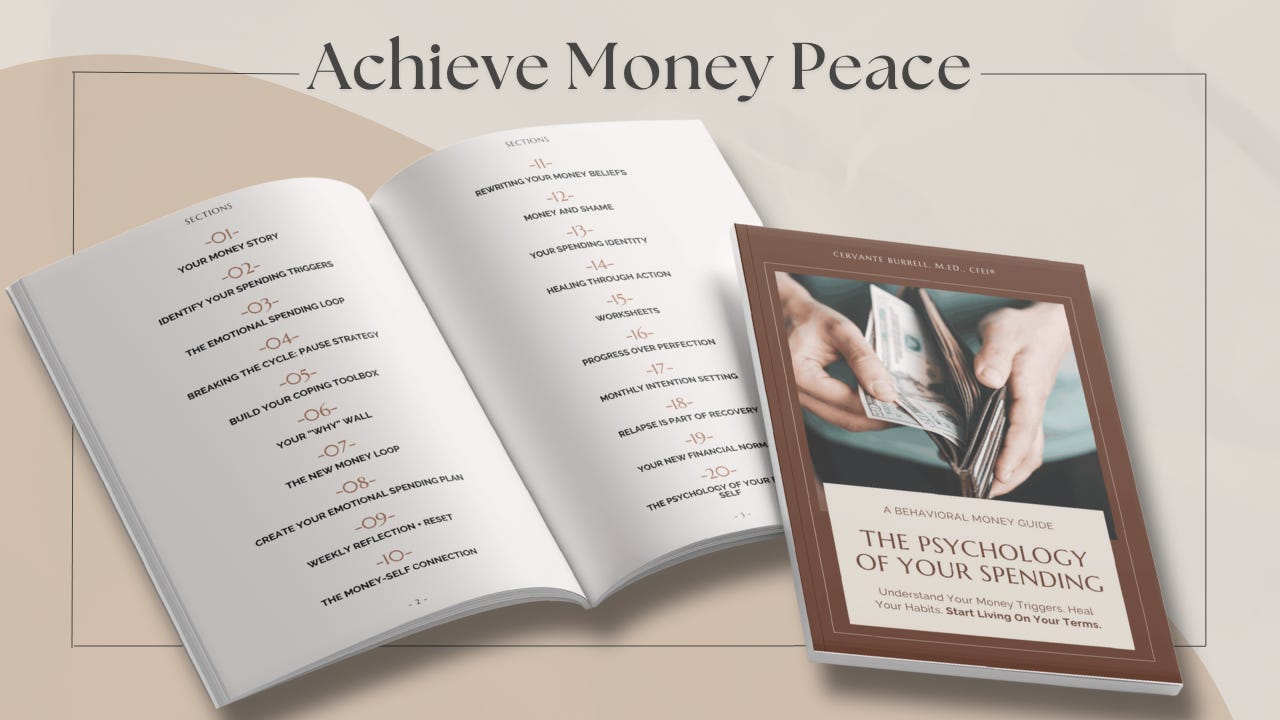

Upgrade for deeper dives into the psychology of money, emotional spending, and mindset shifts that lead to real transformation. New posts every Monday and Wednesday.

Spending Isn’t Just About Math — It’s About Meaning

Every time you spend money, you’re making a choice that extends beyond the transaction. You’re telling yourself what matters. You’re showing your family what you prioritize. You’re casting a vote for your future.

Sometimes the choice is to save more.

Sometimes it’s to invest now.

Sometimes it’s to pause.

Sometimes it’s to say this is worth it.

There are always two options. The fear-based path or the aligned one.

Make It Yours

Buy Now, Pay Later isn’t for everyone, and it shouldn’t be. But it’s not inherently bad, either. Like any financial tool, it can serve you well or hurt you depending on how you use it.

Here’s my personal checklist:

Can I cover the full price if needed?

Is the interest rate 0%?

Will this purchase enhance my daily life or reduce stress?

Am I staying within budgeted amounts?

Do I trust myself to finish paying this off on time?

If the answers line up, I move forward. And if they don’t, I wait.

Because I know I always have two options, and one of them will honor both my money and my peace.

Remember this:

It’s your life. It’s your family. It’s your money.

Let your spending reflect the story you want to tell.

Not the fear someone else wants you to feel.

❤️ If you find this helpful, leave a heart and share to support my work!

peace is so important too

Great article. I am very anti Klarna and have seen the detestation it does to friends and families. That said, I appreciate this take and agree with some of these points. Thanks for the insights. They made me think.