When we think of financial security, our minds often jump straight to images of wealth: mansions, luxury cars, six-figure salaries, and fat investment portfolios. But here’s the truth that gets lost:

You don’t need to be rich to feel financially secure.

Financial security has less to do with how much money you make and more to do with how you manage what you already have. It’s about peace of mind, not just stacks of money. And that peace is available to anyone, no matter your income.

Let’s unpack what real financial security looks like, why chasing “rich” can actually make you feel less secure, and how to create a foundation of stability that helps you breathe easier, starting this moment.

The Lie We’ve Been Sold: Security = Wealth

We live in a culture that glorifies wealth. Instagram reels, YouTube success stories, and even well-meaning finance professionals often send the message that unless you’re pulling in six or seven figures, you’re failing financially.

So let’s challenge that idea.

We’ve all seen high earners who feel just as anxious about money as someone making minimum wage. Why? Because income does not equal peace of mind. Lifestyle inflation, debt, comparison, and poor money habits can follow you no matter how much you earn.

The goal isn’t to be rich. The goal is to be safe, stable, and free.

And that’s a goal you can start working toward today, even if your paycheck isn’t glamorous or where you want it.

What Is Financial Security?

Financial security means:

You can pay your bills on time.

You’re not living paycheck to paycheck.

You have savings to fall back on.

You’re not losing sleep over unexpected expenses.

You feel in control of your financial future.

Notice what’s not on this list:

“Own a yacht.”

“Make $500k a year.”

“Retire at 35.”

Those are fine goals if they truly matter to you. But understand, financial security doesn’t require them.

Why Feeling Secure Is an Inside Job

There’s a surprising emotional side to money that we often overlook. So much of what makes us feel insecure financially isn’t actually about numbers, it’s about mindset.

Here are a few reasons you might feel financially unsafe, even if you’re doing okay on paper:

You grew up in a home where money was always tight.

You fear repeating past financial mistakes.

You compare your life to others on social media.

You’ve tied your self-worth to your bank balance.

These emotional factors can whisper (or scream), “You’re not doing enough!” even when your needs are covered. That’s why true financial security comes not just from your finances, but from your relationship with your finances.

You Can Start Building Financial Security at Any Income

You don’t have to wait for a raise or a windfall to feel more financially grounded. You can start where you are. And it begins with taking small, intentional steps.

1. Know Where Your Money Is Going

Awareness is power. Track your spending for one month without judgment. This isn’t about shame; it’s about understanding. Once you see where your money flows, you can make smarter choices that align with your values.

2. Build a Mini Emergency Fund

Even $500 in a savings account can be the difference between stress and security when life throws a curveball. Aim for a mini emergency fund first, then slowly grow it to 3 to 6 months of expenses if you can (no pressure).

3. Live Below Your Means Without Feeling Deprived

You don’t need to strip your life down to rice and beans to save money. Focus on intentional spending. Cut back on what you don’t value so you can enjoy what matters most without guilt.

4. Get Rid of High-Interest Debt

Debt can be one of the biggest drains on your sense of security. Focus on eliminating high-interest credit card debt first. Every payment you make is an investment in your peace of mind.

5. Automate What You Can

Set up automatic transfers to savings or investments, even if it’s just $10 a week. Over time, those tiny deposits grow and the habit builds confidence.

6. Define What Security Means to You

Forget other definitions. Ask yourself:

What would make me feel secure?

Is it being able to leave a toxic job? Helping your kids through college? Traveling once a year without credit card debt?

Name it. Own it. Plan for it.

You’re Allowed to Feel Safe Now

Too many of us are stuck in “I’ll feel secure when…” thinking.

“I’ll feel safe when I hit six figures.”

“I’ll feel better once the debt’s gone.”

“I’ll relax once I retire.”

If you don’t learn to feel secure on the way, you may never feel it at all. Security isn’t a destination. It’s a series of daily decisions and internal shifts.

You can feel secure now by building habits that support your well-being and speaking more kindly to yourself about where you are financially.

Subscribe to Money Tips Money Hacks for deeper dives into the psychology of money, emotional spending, and mindset shifts that lead to real transformation. New posts every Monday and Wednesday.

What Financial Security Feels Like

Let’s paint a picture:

You check your bank account and don’t feel dread.

You’re not afraid to open bills or talk about money.

You have a plan for your next paycheck and the one after that.

You sleep better because you know you’re covered for a small emergency.

You say “no” to things that don’t align with your priorities without guilt.

You celebrate small financial wins and track progress, not perfection.

None of this requires you to be rich. It just requires you to be intentional.

Peace Over Perfection

Financial security isn’t about reaching a perfect number. It’s about creating a relationship with money that feels steady, respectful, and empowering.

You don’t need to be rich to feel financially secure.

You need clarity.

You need habits.

You need mindset shifts.

You need a little margin.

And you need to know that where you are today is enough to start.

So take a breath. You’re not behind. You’re not broken. You’re not too late.

You’re just one choice away from more peace, and that’s something money can’t buy.

❤️ If you find this helpful, leave a heart and share to support my work!

Cervante Burrell, M.Ed., CFEI®, is the founder of Money Tips Money Hacks, a financial wellness educator, husband, and proud father dedicated to helping others thrive financially from the inside out.

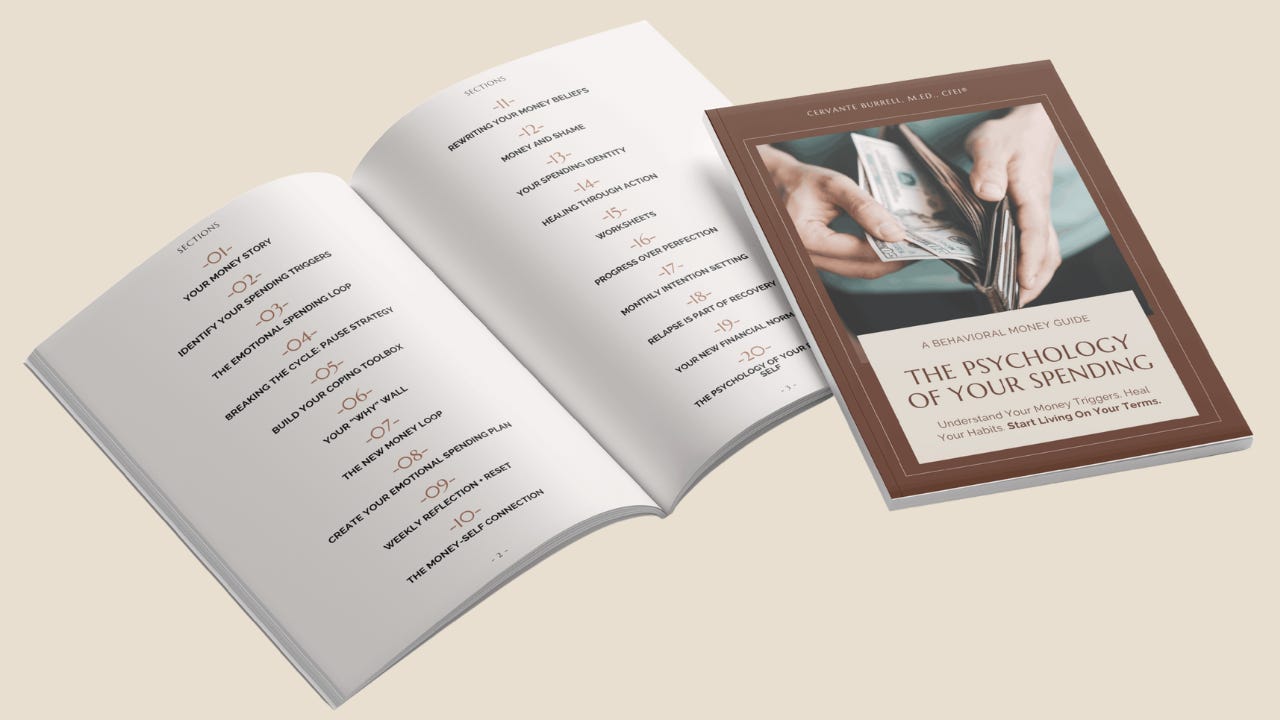

Start spending in alignment with who you are, what you value, and the life you’re actually building.

The Psychology of Your Spending guide shows you how. Coming September 22nd, 2025.

This information is very important to me

Thank you